Ot calculator with tax

OT Dude does not offer a substitute for professional legal or tax advice. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043.

. Ad Automate your sales tax process. This calculator can determine overtime wages as well as calculate the total earnings. The overtime calculator uses the following formulae.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Partner with Aprio to claim valuable RD tax credits with confidence. The algorithm behind this overtime calculator is based on these formulas.

Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software. The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week. Calculate the proper tax on every transaction.

C B PAPR. Easily manage tax compliance for the most complex states product types and scenarios. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens.

Easily manage tax compliance for the most complex states product types and scenarios. See where that hard-earned money goes - with UK income tax National. A financial advisor in Pennsylvania can help you understand how taxes fit into your overall financial goals.

See where that hard-earned money goes - Federal Income Tax Social Security and. If you have questions about your tax liability or concerns about compliance please consult your qualified legal tax. Financial advisors can also help with investing and financial planning -.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. In California overtime must be paid to nonexempt employees in most occupations when the employee works. B A OVWK.

Estimate your tax withholding with the new Form W-4P. You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Texas. Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth.

That means that your net pay will be 37957 per year or 3163 per month. You have nonresident alien status. When California law requires an employer to pay overtime the usual.

Overtime pay per period. Ad Automate your sales tax process. Overtime pay per year.

Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. A RHPR OVTM. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Calculate the proper tax on every transaction. Discover Helpful Information And Resources On Taxes From AARP.

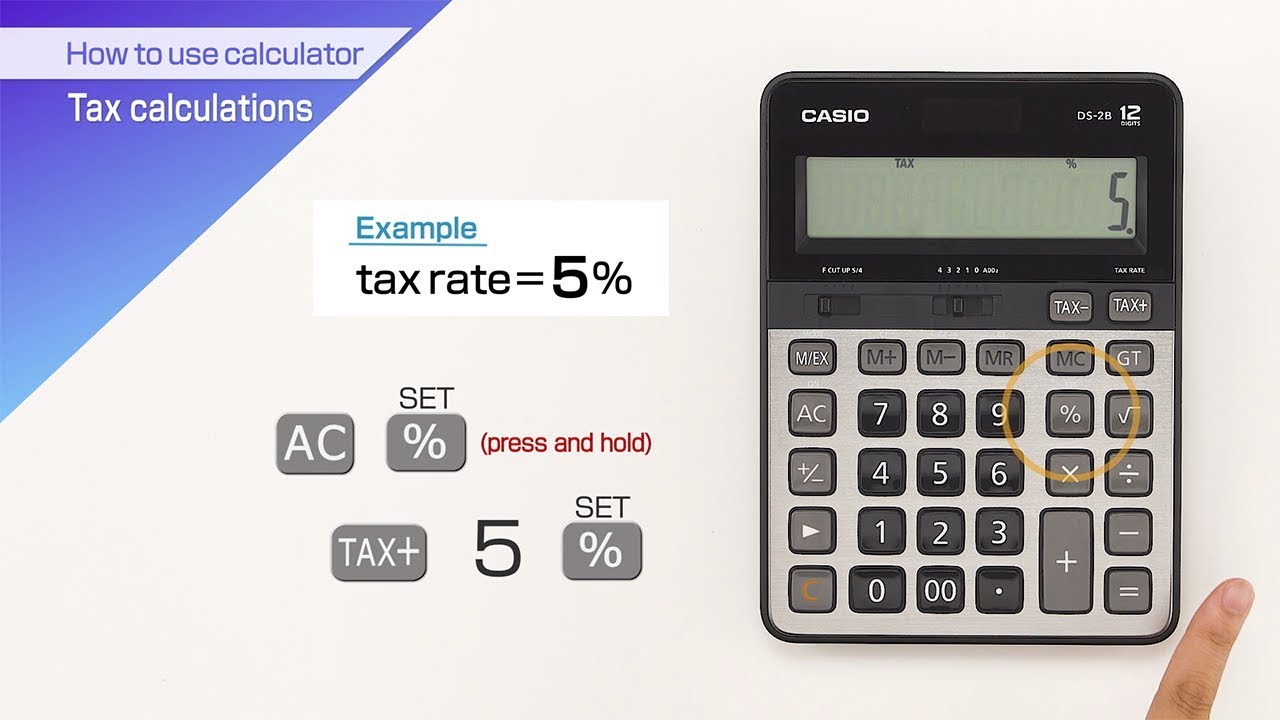

Casio How To Use Calculator Tax Calculations Youtube

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Take Home Pay Calculator

The Freelancer S Approach To Avoiding Gst Headaches In 2022 Goods And Service Tax Investing Goods And Services

Salary Calculator Singapore App Development App Development Companies Mobile App Development Companies

Use This Template To Calculate And Record Your Employee Payroll Three Worksheets Are Included One For Employee Payroll Payroll Template Bookkeeping Templates

Download Adoption Tax Credit Calculator Excel Template Exceldatapro Excel Templates Tax Credits Federal Income Tax

Overtime Calculator

Maharashtra Govt Homeowner Relief Tax

Excel Formula To Calculate Hours Worked And Overtime With Template Excel Formula Excel Life Skills

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

Ms Excel Printable Payroll Calculator Template Excel Templates Payroll Template Excel Templates Payroll

Overtime Calculator How To Calculate Time And A Half

Paycheck Calculator Take Home Pay Calculator

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks

Reverse Sales Tax Calculator

How To Calculate Income Tax In Excel